sponsored by American Aires Inc.

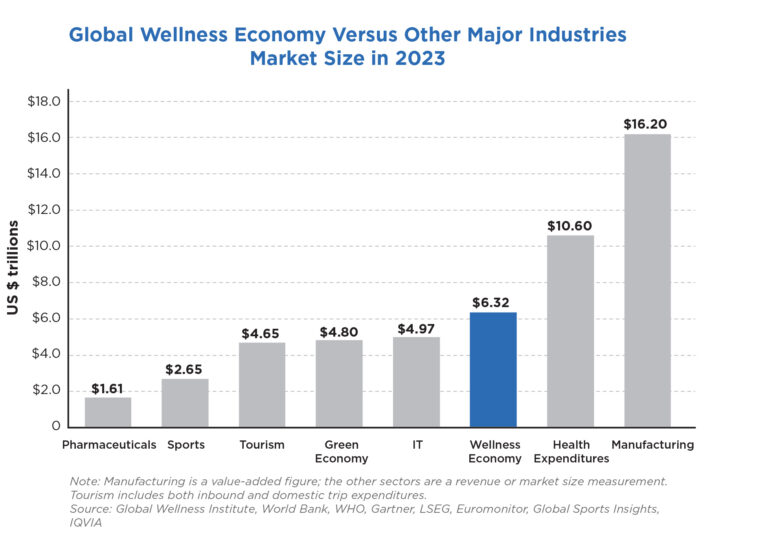

Consumers crave health and wellness like never before.

That’s what’s transformed the wellness market into a thriving $6.3-trillion-dollar global juggernaut that eclipses other major sectors.1

The US segment alone:

- is growing as much as 10% per year

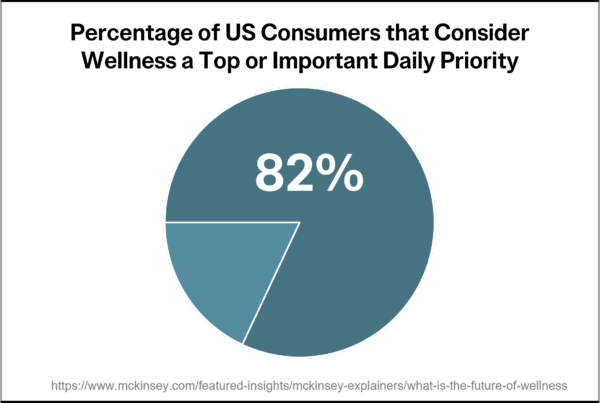

- shows 82% of consumers consider wellness a top or important daily priority2

With millions of consumers becoming more health-conscious, it’s no surprise publicly traded wellness companies are taking advantage by scaling their growth rapidly.

Take Jamieson Wellness. The century-old billion-dollar global supplier of vitamins and supplements recently posted quarterly branded revenue growth of 20%.3

Or Hims & Hers Health. The $12-billion-dollar company has grown their scalable platform –offering personalized fitness and medication solutions – to serve 2+ million users.4

And if the wellness sector can drive growth like that for industry giants, just think how it could supercharge a younger brand with far more valuation upside potential.

For example, tech innovator American Aires Inc. (CSE:WiFi; OTCQB:AAIRF) sells science-backed products that transform our invisible electromagnetic environments to be more bio-friendly.

With the wellness sector’s wind at their back, Aires has attracted major attention…

As Seen On

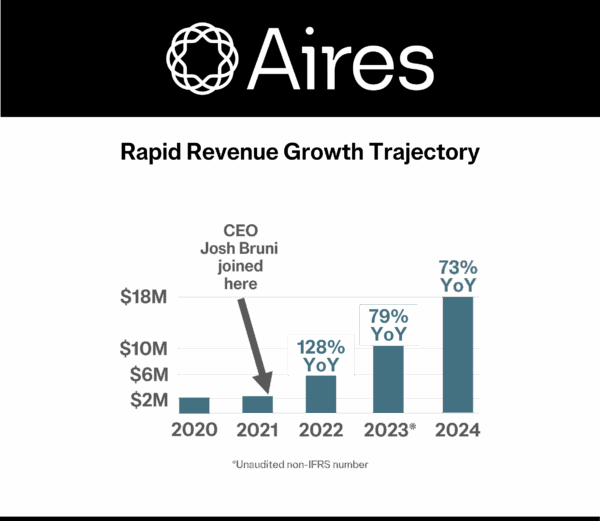

…and grown their revenue by 7x over the last 3 years under new management.

Meet Aires: In-Demand Products, Proven Leadership & Major Valuation Upside

Aires (CSE:WiFi; OTCQB:AAIRF) is ideally positioned at the crossroads between the $2.8+ trillion Life Sciences market5 and the $6.3-trillion Wellness market6.

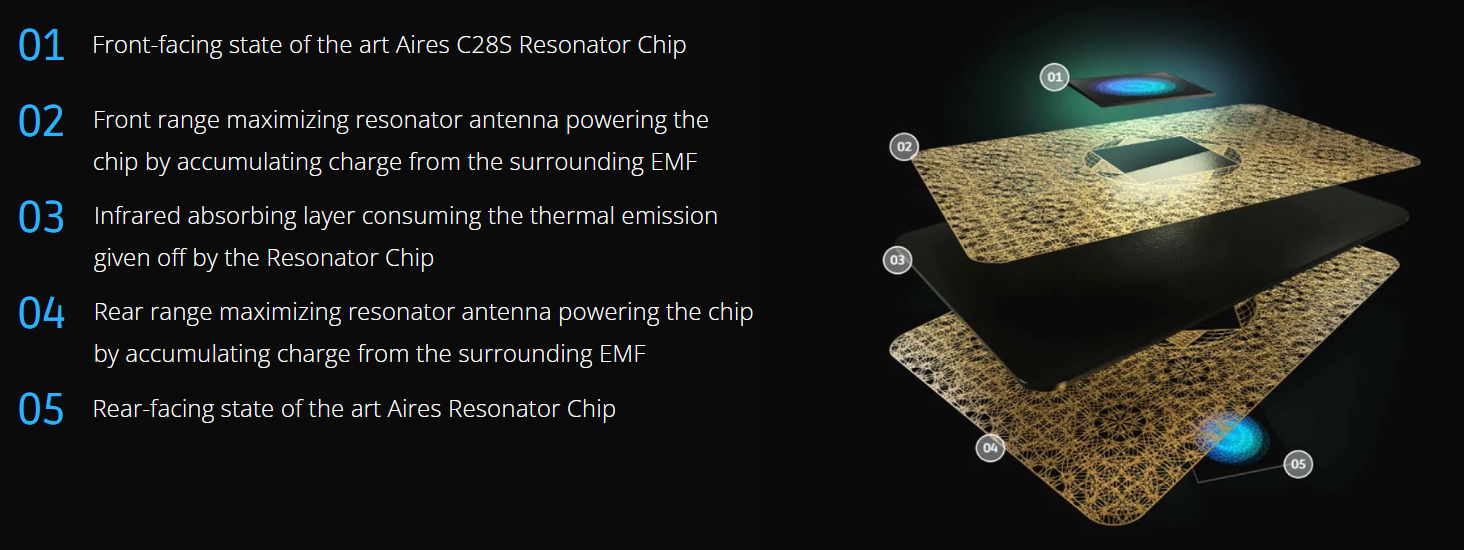

The tech pioneer has sold 400,000+ of their premium science-backed products. Their devices modulate electromagnetic fields (EMFs) from modern electronics to be less chaotic and more bio-friendly.

With sales across 93 countries, Aires is a truly global growth story tapping into the rapidly growing consumer emphasis on wellness and health.

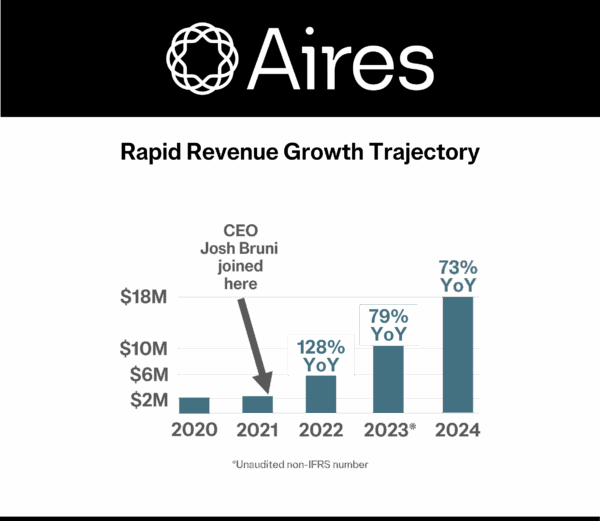

The biggest driver behind Aires’ 7x growth is CEO Josh Bruni, a proven marketing and brand-growth genius who has led growth for top consumer brands over the past 20+ years.

Now Bruni is making Aires (CSE:WiFi; OTCQB:AAIRF) a household brand name aligned with world-class partners that create instant trust and provide massive market exposure.

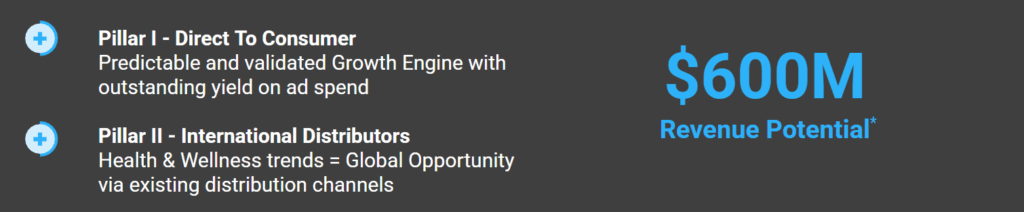

But Aires (CSE:WiFi; OTCQB:AAIRF) has barely started penetrating the estimated $600-million revenue potential of the global consumer market…

…let alone the estimated $2-billion revenue potential of the yet-to-be-tapped co-branding / OEM licensing market (more on that in a moment).7

No surprise then that the leadership team owns about 28% of the Company’s stock and is all-in on extending their strong growth trajectory and dominating their market.

Best of all, while a 2-6x EV/Sales valuation multiple is conservative for Aires (CSE:WiFi; OTCQB:AAIRF) based on Sophic Capital’s latest coverage report8…Aires is currently trading at about 1x EV/Sales, leaving room for major valuation upside.

- Billion-Dollar Global Markets: Positioned where $2.8T Life Sciences market9 and $6.3T Wellness market10 meet

- Rapid Growth Trajectory: 7x revenue growth over the last 3 years from in-demand premium products

- Significant R&D: 30+ years and $20M+ of R&D behind the proprietary tech

- Proven Growth Leadership: CEO led growth for top consumer brands over 20+ years

- World-Class Partnerships: Creating instant trust & providing massive market exposure

- Multi-Tiered Revenue Model: $600M consumer market & untapped $2B co-branding / OEM licensing market potential11

- Skin in the Game: Leadership owns ~28% of the Company’s stock

- Major Valuation Upside: Trading at only 1x EV/Sales versus conservative 2-6x EV/Sales valuation potential based on peers12

Growing Concern Adds to Global Opportunity

Aires (CSE:WiFi; OTCQB:AAIRF) doesn’t just tap into the growing billion-dollar desire for health and wellness.

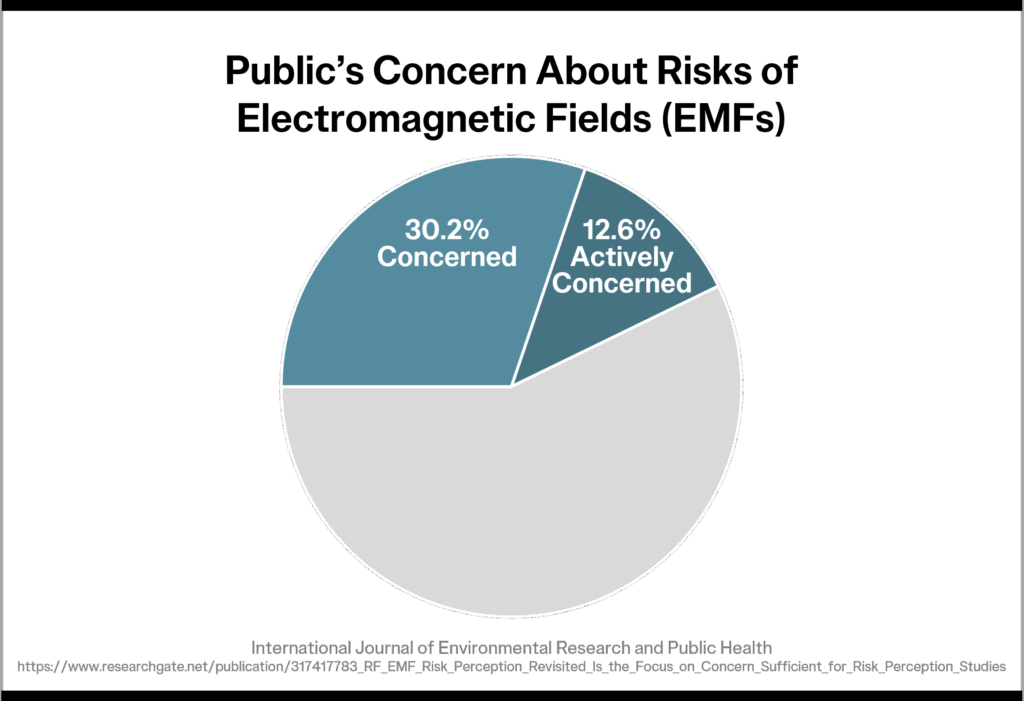

They also address consumers’ concerns over how electronic devices impact our health.

Especially since scientists don’t know the full impact yet, especially over long periods of time.

Those concerns only grow when people hear things like:

- France banned sales of Apple’s iPhone 12 because it exceeded European radiation exposure limits13

- Multiple countries have banned wireless in children’s classrooms to reduce exposure to EMF radiation14

- The US Federal Communications Commission (FCC) recently lost a case after leaving its 25-year-old guidelines for exposure to radiofrequency radiation largely unchanged…the court said the FCC was “arbitrary and capricious in its failure to respond to record evidence that exposure to RF radiation at levels below the Commission’s current limits may cause negative health effects…”15

Then there’s the growing evidence that EMF radiation’s negative effects on health include cognitive functioning, reproductive issues, sleep disturbances, and more.16

With a big chunk of the population concerned about EMFs, and the desire for health and wellness on the rise, Aires (CSE:WiFi; OTCQB:AAIRF) has a primed and ready global market.

Get the Aires Investor Package to Dive Deeper

Sophic Capital’s reports on Aires + Corporate Presentation

Science-Backed EMF Modulation Products Selling Like Hotcakes

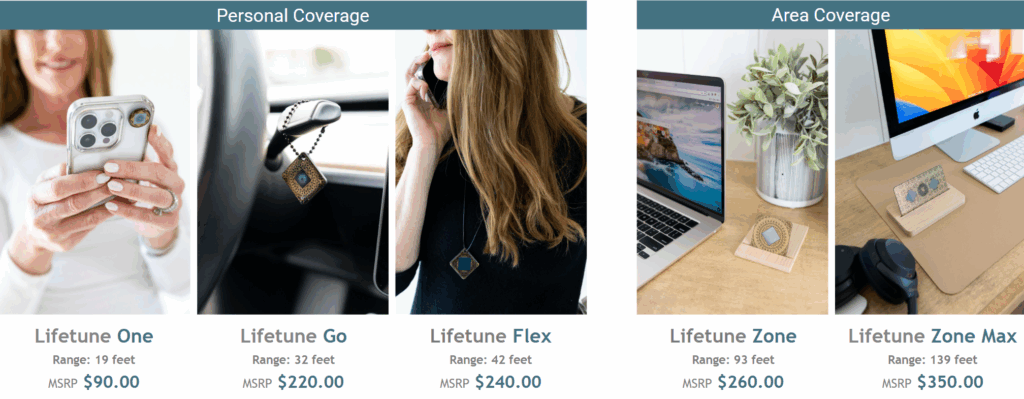

Aires (CSE:WiFi; OTCQB:AAIRF) has already sold over 400,000 premium units directly to consumers across 93 countries. (You can see their product suite below.)

Their customers fall into one or more key consumer personas…or anywhere in between.

Here are some of the top reasons they choose Aires products:

- Their electronics still work normally: that’s because Aires products don’t block EMFs…instead, their proprietary Resonator chip modulates EMFs, changing their structure to be more bio-friendly

- Consumers are getting real-world results: Aires has 1,100+ positive verified reviews with people experiencing better sleep, more energy, and less brain fog

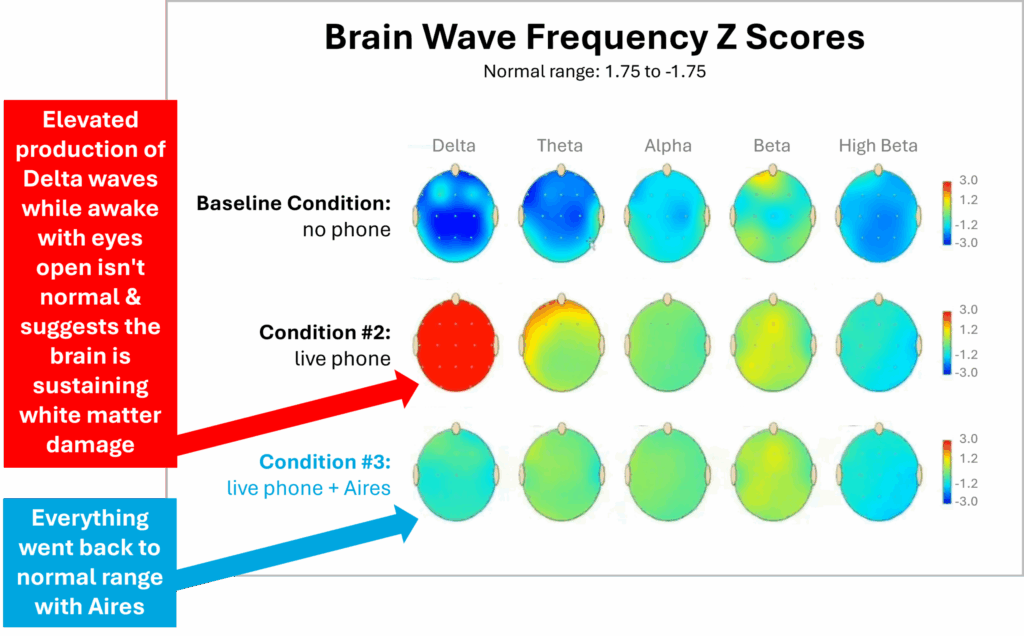

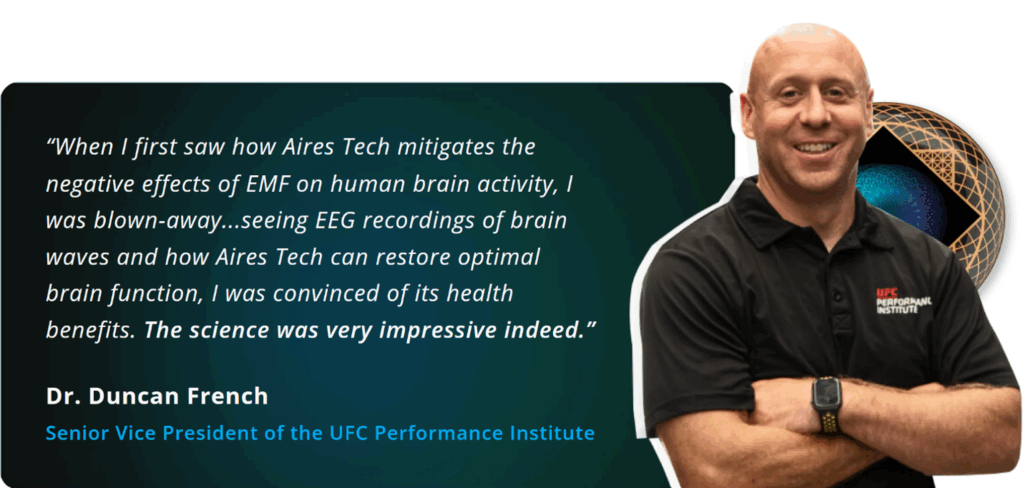

- Neuroscientist demos show positive biological results: data from these demos show EMFs impacting brains and hearts…and how Aires protects from those impacts

When Aires did one of these demos at the UFC’s Performance Institute, here’s the response they got…

You can watch an overview of that UFC demo and some of the results in this video…

- Significant R&D: 30+ years and $20M+ of R&D behind the tech

- Loads of third-party validation: 25 clinical trials; 9 peer-review studies proving positive biological responses18

That’s been more than enough to convince hundreds of thousands of people around the world that Aires (CSE:WiFi; OTCQB:AAIRF) and their unique products are the real deal.

More News From this Company

Aires Announces Record Q2 2025 Revenue of $6.0 Million & 115% YoY Sales Growth

Aires Announces Record First Quarter 2025 Revenue of $5.38 Million & 164% YoY Sales Growth

Aires Announces Record Q4 and Annual 2024 Order Volume

CEO’s 2024 Letter to Shareholders

Aires Announces Record Preliminary Q4/2024 Performance & Provides 2025 Guidance

Positioned to Extend Rapid 60-80% Revenue Growth Trajectory

Aires’ (CSE:WiFi; OTCQB:AAIRF) revenue growth exploded when they brought on proven brand builder and marketing expert Josh Bruni as CEO.

Over the next 3 years, Aires grew sales by 128%, 79% and 73% YoY. That’s 7x revenue growth to hit $18 million in 2024.

Now they’re on track to extend that 60-80% YoY growth trajectory.

In the first half of 2025, Aires’ sales were already up 164% YoY in Q1 and 115% YoY in Q2.

Bruni developed his marketing expertise leading growth at major consumer companies.

Now Aires (CSE:WiFi; OTCQB:AAIRF) is benefitting from everything Bruni learned over 20+ years…and from the data-driven marketing Growth Engine he brought to the table.

“Data-driven” means Aires relies on real-time numbers to know which digital ads to turn off and which to scale up.

Since their Growth Engine is scalable, the more money they put in as fuel, the more they can boost their marketing efficiency and extend their rapid growth trajectory.

Significant Upside Potential Versus Comparables

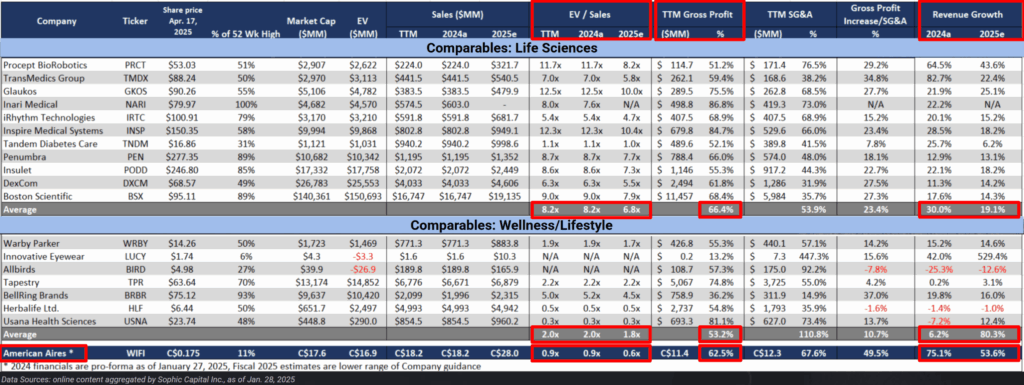

How does Aires’ (CSE:WiFi; OTCQB:AAIRF) performance and potential stack up against Life Sciences and Direct-to-Consumer Wellness/Lifestyle companies?

Just look at the chart below from Sophic Capital’s latest coverage report on Aires.20

Here are the highlights to note:

- Aires’ revenue growth (~54% to 74%) significantly outpaces Life Sciences and Wellness peer averages (~20% average).

- Aires’ Gross Profit margins (63%) are in line with higher-valued Life Science peers (63%) and higher than Wellness peers (56%).

- With EV/Sales multiples averaging ~6.8x for Life Sciences and ~1.8x for Wellness peers, it’s conservative to estimate a 2-6x EV/Sales valuation for Aires, especially since Aires has the added advantages of significant global market upside, co-branding / OEM licensing revenue potential (more on that in a moment), and low segment competition.

But Aires (CSE:WiFi; OTCQB:AAIRF), despite growing at a higher rate than these comparables, is trading at a lower multiple of only around 1x.

That means, based on these numbers, Aires could have between 100% and 600% in EV/Sales valuation upside potential.

World-Class Partnerships Enhancing Marketing Efficiency

By aligning their brand with high-profile performers and organizations, Aires (CSE:WiFi; OTCQB:AAIRF) is able to drive more revenue more efficiently, for several reasons:

1. Mass reach: Aires is introduced to their partners’ millions of fans and followers

2. Instant trust: The “halo effect” means each partner’s credibility transfers to Aires

3. Co-branded content: Aires can fuel its Growth Engine with higher-impact marketing content that features their partners’ faces, conversations, interaction and praise

4. Competitive differentiation: Aires is noticeably the only brand in their market space with this calibre of partners…that sets the brand apart and enhances its reputation

That’s why Aires (CSE:WiFi; OTCQB:AAIRF) continues to lock up key partnerships with sports leagues and organizations…

…and with top athletes who were happy customers first and then organically approached Aires.

Aires is also expanding their brand-building strategy by tapping into the power and reach of mass market programs that focus on everyday people and concerns.

Aires (CSE:WiFi; OTCQB:AAIRF) recently appeared on Health Uncensored with Dr. Drew. The segment “catalyzed a notable uptick in order volume”.23

They also appeared on Military Makeover with Montel Williams as a potential mass-market audience of 63 million24 watched Aires incorporate their EMF protection products into a family’s home.

Watch Aires CEO Josh Bruni on Military Makeover with Montel here

The longer Aires (CSE:WiFi; OTCQB:AAIRF) leverages a partnership, the more marketing efficiency and ROI they’re able to gain.

Diversified Revenue Model for Long-Term Growth Potential

The market share Aires (CSE:WiFi; OTCQB:AAIRF) has captured so far has been on the consumer side of their multi-tiered revenue model.

Aires sees that as a $600-million-dollar revenue opportunity.

They sell direct-to-consumer (DTC), so no middlemen or retailers taking a cut of the revenues.

With about 80% of those sales coming from America, that leaves a lot of room for Aires to target international expansion, including through low-cost, low-effort International Distributorships, where Aires doesn’t have to establish the sales channels or invest in marketing to find the consumers.

Aires has already leveraged this revenue channel through their exclusive distribution partnership with tech health & wellness firm Pürland for Taiwan, Hong Kong and Malaysia.25

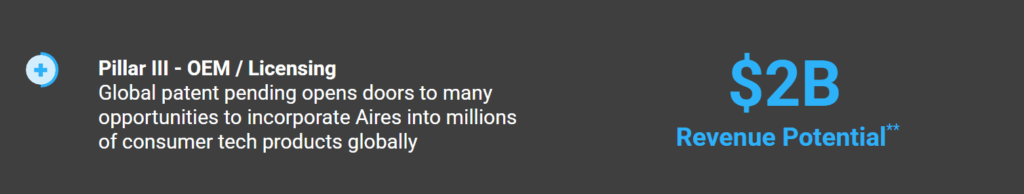

Then there’s the licensing side of Aires’ (CSE:WiFi; OTCQB:AAIRF) revenue model. The first option here is to partner with other brands to create co-branded products. Think limited run Aires products with a UFC logo on it…like when truck manufacturers offer a co-branded Harley Davidson line.

The second option is to get Original Equipment Manufacturers (OEMs) to build the Aires tech into an OEM’s end product.

Think Aires resonator chips in phones, baby monitors, hospital equipment, gaming consoles, electric vehicles, or virtually any of the billions of consumer electronic devices around the world.

No wonder they see it as a $2-billion-dollar longer term upside revenue opportunity.

Aires (CSE:WiFi; OTCQB:AAIRF) locked up their first OEM deal in late 2023 with a tech startup bringing a new sleep-enhancement product to market.26

Since then, the Company’s been focused on growing their retail revenues and stoking consumer demand for EMF radiation protection, which will increase the co-branded opportunities and put pressure on OEMs to license tech like Aires’…or even take out the Company to avoid competition.

And finally, they recently launched Aires Certified Spaces™.

It’s an industry standard that “sets the benchmark for EMF friendly environments”.

That means Aires is now in the business of verifying and certifying spaces that prioritize well-being. Which means they’re targeting high-ticket B2B installations as a new revenue driver.

And their very first Certified Spaces adopter was a big one: NBA’s Minnesota Timberwolves teamed up with Aires to make the Target Center a first-of-its-kind EMF friendly arena.

Aggressive 2-Prong Growth Plan: Grow & Dominate

A lot of companies – small or large – would look at Aires’ (CSE:WiFi; OTCQB:AAIRF) 60-80% YoY rapid growth trajectory as justification to slow down.

But not this Company. Here’s their focused growth plan:

Goal #1: Strong growth while moving toward profitability

- Amplify existing partnerships to create marketing efficiencies that come with having more market awareness and momentum

- Drive self-sustainable 60-80% YoY growth

Goal #2: Dominate the market

- Go beyond sports-related markets to reach mass-market audiences

- Build to $100M in mid term sales to attract co-branding opportunities & apply serious pressure on OEMs to upgrade their products to include the Aires tech

Growth efforts like that can create the kind of catalysts and news flow that markets want to hear about.

Non-Dilutive Debt, Near-Term Runway & Skin in the Game

As the Aires (CSE:WiFi; OTCQB:AAIRF) leadership works on balancing the Company’s rapid growth with their mid-term goal of moving toward Adjusted EBITDA profitability27, they have some important advantages working in their favor:

- Investor-friendly debt: They recently secured extra working capital without diluting the stock by leveraging low-cost inventory-as-collateral loans.28

- Management holds about 28% of the stock: Skin in the game creates a serious incentive to build the kind of company structure that’s sustainable, scalable and appealing to investors and the market.

Capital Structure

All figures as of Apr. 03, 2025

Shares Issued & Outstanding | 104,607,000 |

Warrants & Options Outstanding | 24,688,244 |

Fully Diluted Shares Outstanding | 129,295,244 |

Management Ownership | 28% |

Market Capitalization @ C$0.10 | $10M |

Proven Team That’s Been Around this Block Before

Aires (CSE:WiFi; OTCQB:AAIRF) has kept costs low by having a lean team of industry pros that know what to do, from growing world-class brands to creating cutting-edge products and navigating capital markets.

Josh Bruni, CEO & Director

- 20+ years of successful growth marketing & e-commerce leadership

- Led growth for international consumer brands and startups across multi-billion-dollar categories, including PacSun, Ancestry.com, NordicTrack, 7 For All Mankind, Reckitt Benckiser, and more

- Supercharges growth through predictable & scalable data-driven marketing and e-commerce models while drawing on entrepreneurial and direct-to-consumer expertise

- Business building track record includes launching, leading and coaching many startups, including Lendio, Altra Footwear and TeeFury

Vitaliy Savitsky, CFO

- 15 years experience in capital markets, mostly with Canaccord Genuity in institutional equity research covering small and large cap tech stocks

- Built out Business Dev department at FinTech startup Soundays, partnering with JP Morgan Chase, Visa, Mastercard, Amazon and eBay

- Founded, built & sold Comfort.to, a Toronto-based Costco Wholesale grocery delivery business

Grant Pasay, Communications Director

- 20+ years creating marketing, IR and investor awareness content

- Contributed to campaigns for public & private companies across 60+ sectors in Canada, the US and Europe, including Qtrade, IHS, OilPrice.com, PrecisionIR, and more

- Co-founded a digital marketing company in the early days of the Internet (1999)

- Billion-Dollar Global Markets: Positioned where $2.8T Life Sciences29 market and $6.3T Wellness market30 meet

- Rapid Growth Trajectory: 7x revenue growth over the last 3 years from in-demand premium products

- Significant R&D: 30+ years and $20M+ of R&D behind the proprietary tech

- Proven Growth Leadership: CEO led growth for top consumer brands over 20+ years

- World-Class Partnerships: Creating instant trust & providing massive market exposure

- Multi-Tiered Revenue Model: $600M consumer market & untapped $2B co-branding / OEM licensing market potential31

- Skin in the Game: Leadership owns ~28% of the Company’s stock

- Major Valuation Upside: Trading at only 1x EV/Sales versus conservative 2-6x EV/Sales valuation potential based on peers32

With wellness a top priority for 80%+ of consumers33, and concern about EMF radiation only expected to grow, Aires (CSE:WiFi; OTCQB:AAIRF) is ideally positioned as the go-to brand for electromagnetic environment solutions worldwide.

News flow of continued strong revenue growth and any movement toward profitability are likely to attract a lot of market attention.

If you’re interested in tech/wellness opportunities with major valuation upside, keep a close eye on Aires (CSE:WiFi; OTCQB:AAIRF).

Download the Company Presentation: click here

Get the Aires Investor Package to Dive Deeper

Sophic Capital’s reports on Aires + Corporate Presentation

More News From this Company

Aires Announces Record Q2 2025 Revenue of $6.0 Million & 115% YoY Sales Growth

Aires Announces Record First Quarter 2025 Revenue of $5.38 Million & 164% YoY Sales Growth

Aires Announces Record Q4 and Annual 2024 Order Volume

CEO’s 2024 Letter to Shareholders

Aires Announces Record Preliminary Q4/2024 Performance & Provides 2025 Guidance

- https://globalwellnessinstitute.org/press-room/statistics-and-facts/

- https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-the-future-of-wellness

- https://www.jamiesonwellness.com/English/news-and-media/company-news-and-media-releases/media-release-details/2024/Jamieson-Wellness-Inc.-Reports-Third-Quarter-2024-Results/default.aspx

- https://finance.yahoo.com/news/health-fitness-stocks-buy-wellness-115800250.html

- https://www.deloitte.com/cn/en/Industries/life-sciences-health-care/perspectives/global-life-sciences-sector-outlook-2023.html

- https://globalwellnessinstitute.org/press-room/statistics-and-facts/

- $600M revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 10% Aries Market Share and $400 Consumer LTV; $2B revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 5-10% Aries Market Share and wholesale pricing

- https://sophiccapital.com/american-aires-price-is-still-right/

- https://www.deloitte.com/cn/en/Industries/life-sciences-health-care/perspectives/global-life-sciences-sector-outlook-2023.html

- https://globalwellnessinstitute.org/press-room/statistics-and-facts/

- $600M revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 10% Aries Market Share and $400 Consumer LTV; $2B revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 5-10% Aries Market Share and wholesale pricing

- https://sophiccapital.com/american-aires-price-is-still-right/

- https://www.reuters.com/technology/why-has-france-banned-sales-apples-iphone-12-2023-09-13/

- https://ehtrust.org/why-are-doctors-concerned-about-the-health-effects-of-wireless-and-cell-phones-in-schools/

- https://www.natoa.org/news/dc-circuit-decision-in-rf-case

- https://airestech.com/blogs/emf-101/is-emf-really-that-harmful-answers-from-the-latest-research

- https://patentscope.wipo.int/search/en/detail.jsf?docId=WO2021064446

- https://airestech.com/pages/tech

- https://investors.airestech.com/2025/01/27/american-aires-announces-record-preliminary-q4-2024-performance-provides-2025-guidance/

- https://sophiccapital.com/american-aires-price-is-still-right/ (NOTE: On Sept. 24, 2024, Aires entered into a capital markets advisory agreement with Sophic Capital Inc. under which Sophic provides Aires with marketing and investor relations services to expand investor awareness of the Company’s business and to communicate with the investment community.)

- https://www.ufc.com.br/news/ufc-launches-channel-kickcom-new-global-partnership

- https://www.instagram.com/reel/DCXionuvnWk/?igsh=MWRsNDlsb2pjYnV6cQ%3D%3D

- https://investors.airestech.com/2024/06/18/american-aires-provides-corporate-update-on-robust-fundamentals-sales-growth-commitment-to-scaling-into-global-health-tech-leader/

- https://wrestlenomics.com/u-s-cable-network-households-universe-1990-2023-nielsen-data/

- https://finance.yahoo.com/news/american-aires-announces-exclusive-distribution-123000015.html

- https://finance.yahoo.com/news/american-aires-omsleep-announce-oem-130000025.html

- https://investors.airestech.com/2024/08/26/american-aires-announces-q2-2024-results-with-strong-45-yoy-sales-growth-and-engages-clarkham-capital-ltd/

- https://investors.airestech.com/2025/01/27/american-aires-announces-record-preliminary-q4-2024-performance-provides-2025-guidance/

- https://www.deloitte.com/cn/en/Industries/life-sciences-health-care/perspectives/global-life-sciences-sector-outlook-2023.html

- https://globalwellnessinstitute.org/press-room/statistics-and-facts/

- $600M revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 10% Aries Market Share and $400 Consumer LTV; $2B revenue potential: Company estimate, assuming 80% adult population, 13% addressable market, 5-10% Aries Market Share and wholesale pricing

- https://sophiccapital.com/american-aires-price-is-still-right/

- https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-the-future-of-wellness

LEGAL DISCLAIMER

SPONSORED CONTENT. This publication was issued by American Aires Inc. (the “Issuer”) as part of an investor awareness campaign (the “Campaign”). The Campaign is not a recommendation to buy or sell securities. The Campaign includes a profile of the Issuer’s stock: CSE:WiFi; OTCQB:AAIRF (the “Stock”). To enhance public awareness of the Stock, the Issuer has provided this publication for the Campaign, which began on June 20, 2025 and which currently does not have an end date scheduled. The Campaign’s content will appear on airestech.com and pursuitofprime.com. Paid digital ads will appear on the Google Ads, META, Taboola, and Reddit ad platforms. All content created for the Campaign (a) was exclusively based on information generally available to the public that does not contain any material, non-public information and (b) received sign-off for accuracy from the Issuer.

Since the Issuer has provided this publication for the Campaign, that is a major conflict with its ability to be unbaised.

This publication is not, nor is it intended to be, a solicitation for investment or funds, or an offering of securities, or financial advice, and should not be construed or interpreted as such. Any action a reader takes upon the information in this publication is strictly at their own risk and of their own responsibility. All investments represent risk and each reader is encouraged to perform their own due diligence, to consult with their financial professional or investment advisor, and to carefully read and consider the risk factors identified and discussed in the Issuer’s legal filings. The Issuer is not an investment advisory service nor a broker-dealer and does not provide investment advice. The Issuer does not buy, sell, offer, or provide any other opinion, analysis, or rating on the securities we discuss. No information in this publication constitutes advice or a recommendation. All information available in this publication should be considered as information, entertainment or commercial advertisement and not an offer, endorsement, or recommendation to buy or sell securities. The information in this publication is for informative or entertainment purposes only and is not to be treated as a recommendation to make any specific investment. The opinions and analyses included in this publication related to the profiled companies represent the personal and subjective views and opinions of the authors of the information and are subject to change at any time without notice.

NOT AN INVESTMENT ADVISOR. The Issuer and its owners, principals, managers, employees, agents and assigns are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH. Consult with a licensed investment professional before making an investment. This publication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, all investments come with risks. Be aware of the risks and be willing to accept them in order to invest in any type of security. Do not trade with money you cannot afford to lose. This is neither a solicitation nor an offer to buy or sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Any comparisons made to other featured companies or past performance is not indicative of future results.

Any information in this publication that demonstrates the past performance or past or current attributes of the Issuer or any other entity mentioned in this publication are intended only to illustrate past performance or past or current attributes of the Issuer or other such entities, and are not necessarily indicative of future performance of the Issuer or other such entities. Past results of any issuer do not guarantee future performance. The information in this publication should not be interpreted in any way, shape, form or manner whatsoever as an indication of an Issuer’s future Stock price or future financial performance, and should not be relied on when making an investment decision.

The publication may increase investor awareness and market awareness, which may result in (a) an increased number of shareholders owning and trading the Stock, (b) increased trading volume of the Stock, and (c) possibly an increased share price of the Stock, which may or may not be temporary and which may decrease after the Campaign has ended.

FORWARD-LOOKING STATEMENTS AND LEGAL DISCLAIMERS – PLEASE READ CAREFULLY

This publication contains forward-looking statements within the meaning of applicable securities law, which reflect expectations regarding the future anticipated performance, growth, and plans of the Issuer as well as those of other companies. Any statements in this publication that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, should be viewed as forward-looking statements. Forward-looking statements can be generally identified through phrases such as “potentially”, “possibly”, “anticipates”, “estimates”, “intends”, and other words of similar connotation. Statements in this publication that speak to a company’s business objectives, intentions, and/or strategies should also be viewed as forward-looking statements.

Such forward-looking statements involve a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of the Issuer to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) the Issuer’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises may adversely impact the Issuer’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing the Issuer’s business operations; (e) the Issuer may be unable to implement its growth strategy; and (f) increased competition.

These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to the Issuer’s industry; (b) market opportunity; (c) the Issuer’s business plans and strategies; (d) services that the Issuer intends to offer; (e) the Issuer’s milestone projections and targets; (f) the Issuer’s expectations regarding receipt of approval for regulatory applications; (g) the Issuer’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) the Issuer’s expectations regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions by the Issuer in light of the Issuer’s experience and perception of trends, current conditions and expected developments, as well as other factors that the Issuer believes to be relevant and reasonable in the circumstances, as of the date of this publication including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute the Issuer’s business plan; (b) that general business and economic conditions will not change in a materially adverse manner; (c) the Issuer’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) the Issuer’s ability to enter into contractual arrangements; (e) the accuracy of budgeted costs and expenditures; (f) the Issuer’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; and (j) stability in financial and capital markets.

Except as required by law, the Issuer undertakes no obligation to revise or update any forward-looking statements, whether as a result of new information, future event or otherwise, or to reflect the occurrence of unanticipated events, after the date on which the statements are made. Neither the Issuer nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this publication. Neither the Issuer nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to any person resulting from the use of the information in this publication by you or any of your representatives, or for omissions from the information in this publication.